Several blockchain projects are considering proof-of-stake mechanisms in place of proof-of-work, attracted by the lower energy costs. Some proof-of-stake protocols based on BFT systems such as HotStuff or Tendermint appear to provide faster and deterministic finality. In these protocols, a set of nodes known as validators, that are identified by their public key, operates the consensus protocol such that any user can verify it using only publicly available information by verifying the validators’ signatures. The set of validators changes periodically, with respect to a specific governance mechanism.

However, as any consensus protocol that is not based on resource consumption (such as proof-of-work, proof-of-space and so on) they are vulnerable to an attack known in the literature as Long-Range Attack. In a Long-Range Attack, an adversary obtains the secret keys of past validators (e.g., by bribing them at no cost since they do not use these keys any more) and is thus able to re-write the entire history of the blockchain with those. A user that has been offline for a long period of time could then be fooled by the adversarial chain.

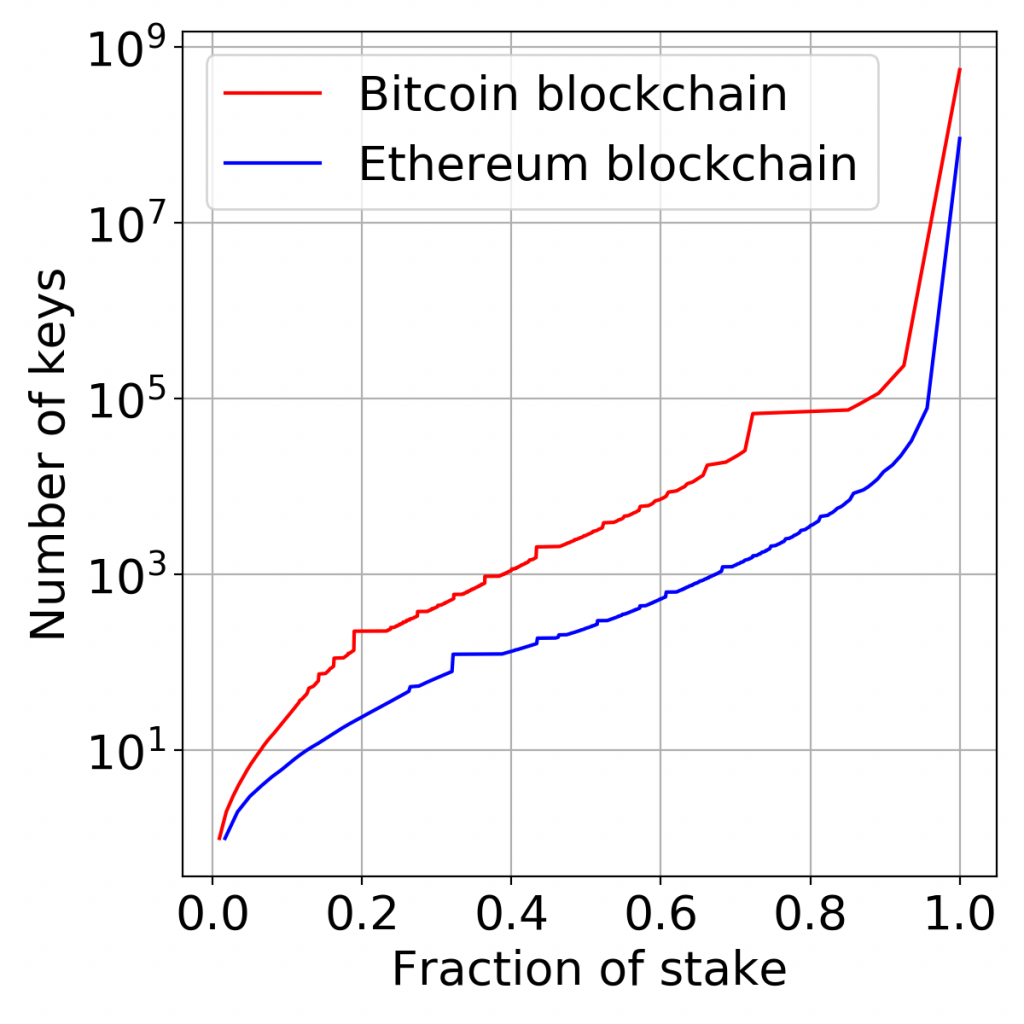

To solve this problem, we propose Winkle, a decentralised checkpointing mechanism operated by coin holders, whose keys are harder to compromise than validators’ as they are more numerous. By analogy, in Bitcoin, taking control of one-third of the total supply of money would require at least 889 keys, whereas only 4 mining pools control more than half of the hash power (see figure above).

Our Protocol

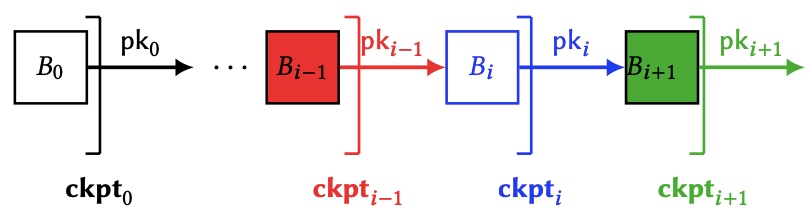

The idea of Winkle is that coin holders will checkpoint the honest chain, such that if an adversary creates an alternative chain, its chain will not be checkpointed (since the adversary does not control the keys of coin holders) and is thus easily differentiable from the honest chain.

Continue reading Winkle – Decentralised Checkpointing for Proof-of-Stake